Company mergers can be handled within Portfolio Manager in a couple different ways. This

depends on the tax ruling for that merger as each merger differs slightly. For this reason, a

generic approach has been taken, allowing you to change any steps along the way if required.

You will most likely need to speak to your accountant to determine the correct method of

accounting for the merger.

If CGT scrip for scrip rollover relief is not available then you essentially sell the stock as normal

on the date and amount specified by the merger and then add a new stock in for the new

company. If it is available then you will need to do several things to merge the stock into another

company.

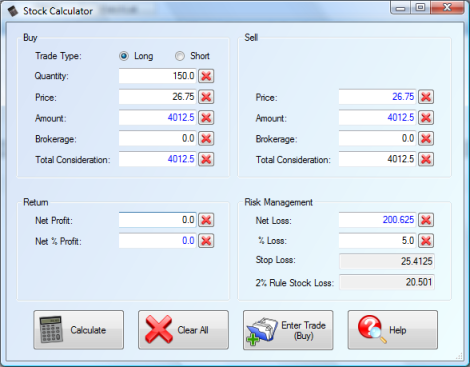

1. Sell the transaction at zero profit, removing the brokerage cost. This keeps your history

of

that stock along with any dividends you may have received without having any effect on your

capital gains. You can determine the required values by using the Stock Calculator.

Select

the stock from the list and click the stock calculator icon. This will auto fill in most of the

details for you. Remove the buy brokerage writing it down for later use. You can then enter

in 0 for the sell brokerage and required profit of 0 and then read the sell values off the screen.

In this case you would need to sell the stock for 26.75. Note that there is no brokerage as it

is a paper sell. It will be included when you sell the new stock.

Edit the transaction to remove the buy brokerage and then sell the stock as normal with 26.75

as the sell price with a sell date of the date of the merger. Optionally enter in a trade note

such as "SGB merged with WBC"

2. Using the documentation from the merger you know how many units of the new stock you

have been issued. In the case of this example, I have received 197 WBC units for my 150

SGB. Using the above example you would need to enter a transaction with a an amount of

4012.5 using 197 units and then include the 16.45 buy brokerage (from the original SGB

transaction). Again you can use the stock calculator to determine the rest of the values and

then click the 'Enter Trade' button to take you directly to adding a new stock and auto fill in

some of the details for you.

3. Add a new trade for WBC with your original buy date from SGB and the calculated number of

units and buy price. Again enter an optional trade note such as "Received 1:31 WBC for

every SGB".

In this case, 197 units at 20.368 per unit with 16.45 buy brokerage would give me a total

transaction amount of $4028.95 which is the same total amount as the original SGB

transaction cost.

4. Finally set the original DRP value to be the quantity held and then add a new DRP allocation

of 0 on the date of the merger. Since we entered the same buy date as our SGB buy date,

this stops this transaction from including any dividends from before the date of the merger.